Corporate Governance

Corporate Governance

Extracted from Annual Report 2025

The Board of Directors (the "Board" or the "Directors") and the management (the "Management") of Yongmao Holdings Limited (the "Company") recognise the importance of sound corporate governance in protecting the interest of its shareholders as well as strengthening investors' confidence in its management and financial reporting.

The Company, together with its subsidiaries (the "Group"), continue to be committed to setting in place corporate governance practices to provide the structure through which the objectives of protection of shareholders' interests and enhancement of long-term shareholders' value are met.

This report outlines the Company's corporate governance practices throughout the financial year ended 31 March 2025 ("FY2025"), with specific reference to the principles and the provisions of the Code of Corporate Governance 2018 (the "Code"), issued by the Monetary Authority of Singapore on 6 August 2018 and amended on 11 January 2023, as well as the accompanying Practice Guidance. It sets out the Company's approach to each of the Code's principles and guidelines, the extent of its compliance with the Code, and, where applicable, the Listing Manual of the Singapore Exchange Securities Trading Limited ("SGX-ST") (the "Listing Manual") . The Company has complied in all material aspects with the principles and guidelines set out in the Code and any deviations from the Code are explained in this report.

BOARD MATTERS

The Board's Conduct of Affairs

Principle 1: The company is headed by an effective Board which is collectively responsible and works with Management for the long-term success of the company.

The Company is headed by an effective Board comprising seven Directors of whom three Executive Directors, one Non-Executive and Non-Independent Director and three Independent Directors. Their combined wealth and diversity of skills, experience, gender and knowledge of the Company enables them to contribute effectively to the strategic growth and governance of the Group.

The Board assumes responsibility for stewardship of the Company and the Group, and is primarily responsible for the protection and enhancement of long-term shareholders' value and returns for the shareholders. It strives to achieve this by providing the leadership and guidance to the Management to develop and drive business directions and goals. The Board also sets the tone for the Group where ethics and values are concerned.

Besides its statutory responsibilities, the Board also:

- Provides entrepreneurial leadership and guidance on the overall strategic direction, oversees the proper conduct of the business, performance and affairs of the Group and ensure that the necessary financial, human and operational resources are in place for the Company to meet its objectives;

- Oversees the processes of evaluating the adequacy and effectiveness of internal controls, risk management, financial reporting and compliance;

- Ensures the Management discharges business leadership and management skills with the highest level of integrity;

- Approves major investment and divestment proposals, material acquisitions and disposal of assets, major corporate policies on key areas of operations, annual budget, the release of the Group's half and full year financial results and interested person transactions of a material nature;

- Sets the Company's values and standards to ensure the obligations to shareholders and others are understood and met;

- Assumes responsibility for corporate governance;

- Considers sustainability issues, e.g. environmental and social factors, as part of its strategic formulation; and

- Identifies the key stakeholder groups and recognises that their perceptions affect the Company's reputation.

Independent Judgement

The Board provides shareholders with a balanced and clear assessment of the Group's performance, position and prospects on a semi-annually basis. All Directors exercise due diligence and independent judgment and are obliged to act in good faith and consider at all time the interest of the Company. The Directors have the appropriate core competencies and diversity of experience that enable them to contribute effectively. They are able to objectively raise issues and seek clarification as and when necessary from the Board and the Management on matters relating to their area of responsibilities and actively help the Management in the development of strategic proposals and oversees the effective implementation by the Management to achieve the objectives set. The Board puts in place a code of conduct and ethics, sets desired organisational culture and ensures proper accountability within the Group.

Conflict of Interest

Every Director of the Company is required to disclose any conflict or potential conflict of interest, whether direct or indirect, in relation to a transaction or proposed transaction within the Group as soon as practicable after the relevant facts have come to his/her knowledge. On an annual basis, each Director is also required to submit the details of his/her associates for the purpose of monitoring interested person transactions. When there is conflict or potential conflict of interest, the concerned Directors shall, abstain from voting, and recuse themselves from discussion or decision making involving the issue of conflict and related matters.

Director Induction, Training and Development

The Company conducts briefing and orientation programs for new Directors to familiarise themselves with the Company's organisation and business structures, operations and governance policies. Upon appointment, each newly appointed Director will be briefed by the Chief Executive Officer ("CEO") and/or Senior Management of the Company on the business activities of the Group and its strategic directions, as well as setting out their duties and responsibilities as Directors. The aim of the orientation program is to give Directors a better understanding of the Company's business and allow them to assimilate into their new roles. New Directors are also informed about matters such as the Code of Dealing in the Company's shares. Changes to regulation and accounting standards are monitored closely by the Management. The Board as a whole is updated regularly on risk management, corporate governance, insider trading and key changes in the relevant laws and regulations, changing commercial risks and business conditions to enable them to make well-informed decisions to properly discharge their duties as Board or Board Committee members. The Independent Directors are also engaged full time in their respective profession and keep updated in their fields of knowledge.

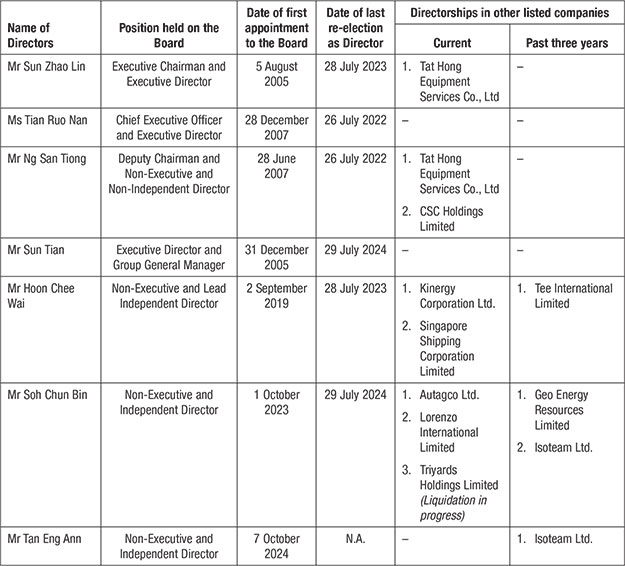

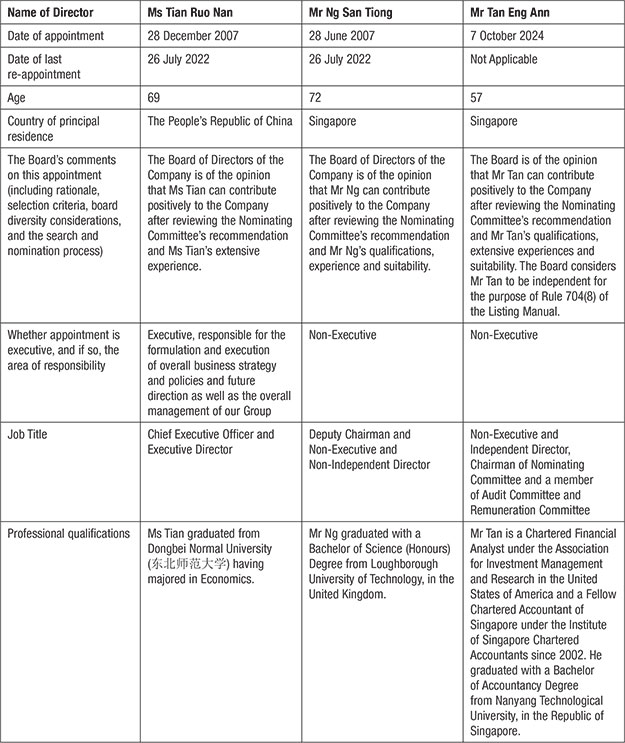

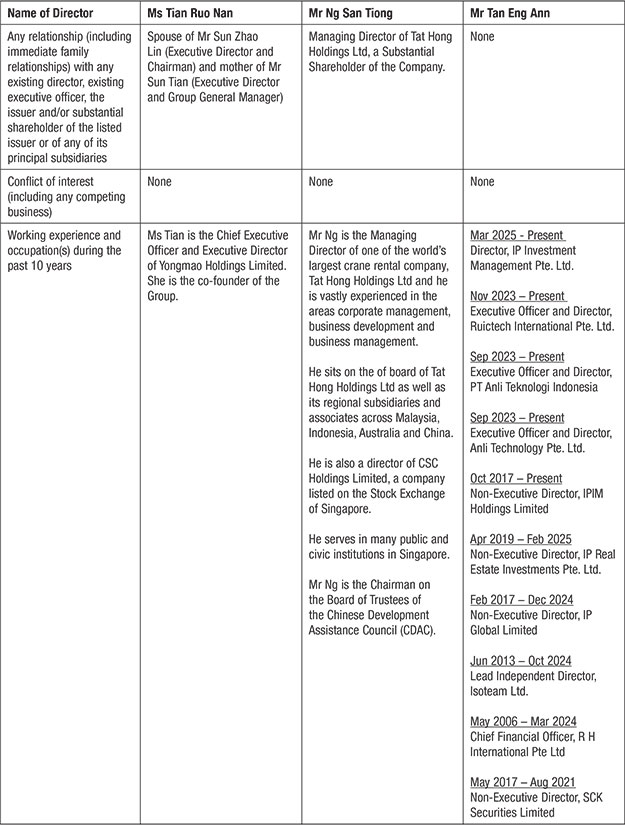

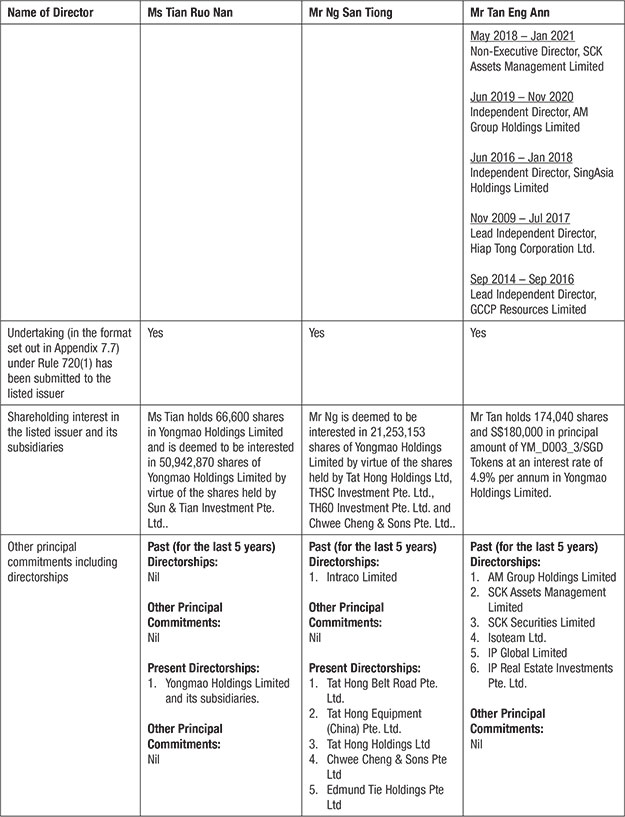

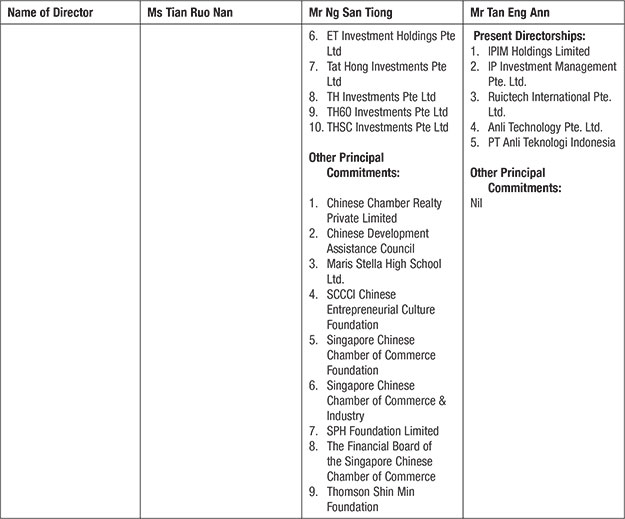

Mr Tan Eng Ann was appointed as a Non-Executive and Independent Director during the financial year. He has been familiarised with the various businesses and operations of the Group. Mr Tan Eng Ann has taken up similar positions in other companies listed on the Exchange over the years and has more than 25 years of experience in the financial field. He is familiar with the roles and responsibilities required as a Director of the Company.

Directors also have the opportunity to visit the Group's operational facilities, including overseas offices, and meet with the Management to facilitate a better understanding of the Group's business operations. This is typically done on an annual basis.

New releases issued by SGX-ST and Accounting and Corporate Regulatory Authority ("ACRA"), which are relevant to the Directors are circulated to the Board. The Company Secretaries and/or their representatives also inform the Directors of upcoming conferences and seminars relevant to their roles as Directors of the Company. The External Auditors would update the AC and the Board on new and revised financial reporting standards annually.

The Company has an on-going budget for all Directors to attend appropriate courses, conferences, exhibitions, fairs and seminars for them to stay abreast of relevant business developments and outlook. These include programmes conducted by the Singapore Institute of Directors or other training institutions.

The Company had arranged for all the Directors to undergo training on sustainability reporting. All Directors of the Company have attended and completed the sustainability training courses conducted by providers that represent different constituencies in the capital markets.

Matters Requiring Board Approval

The Company has adopted internal guidelines setting forth matters that require the Board's approval which has been clearly communicated to the Management. Matters that specifically require Board's approval are those involving annual plans, major funding and investment proposals, mergers and acquisition transactions, release of financial results announcements and any other announcements, appointment of Directors and key management personnel and all other matters of material importance. The Board will review the guidelines on a periodical basis to ensure their relevance to the operations of the Company.

The Management is responsible for the day-to-day operation and administration of the Company in accordance with the objectives, strategies and policies set by the Board. The Company has adopted a set of Approving Authority and Limit, setting out the level of authorisation required for specified transactions, including those that require the Board's approval.

Board Committees

The Directors recognise the importance of good corporate governance and in maintaining high standards of accountability to the shareholders. In order to provide an independent oversight and discharge its responsibilities more efficiently and to ensure that specific issues are subject to considerations and review before the Board makes its decisions, the Board has delegated certain functions to the Board Committees. The Board Committees consist of Audit Committee ("AC"), Nominating Committee ("NC") and Remuneration Committee ("RC") (collectively "Board Committees"). These Board Committees are chaired by Independent Directors and operate within clearly written terms of reference and operating procedures, compositions, authorities and duties, including reporting back to the Board and play an important role in ensuring good corporate governance in the Company and within the Group. These terms of reference of the Board Committees are reviewed on a regular basis to ensure their continued relevance and to enhance the effectiveness of these Board Committees. The Chairman of the respective Board Committees will report to the Board on the outcome of the Board Committees' meetings and their recommendations on the specific agendas mandated to the Board Committees by the Board. Please refer to the relevant section in this report on the composition of the Board and Board Committees for FY2025.

The Board is free to request for further clarification and information from the Management on all matters within their purview. The schedule of all the Board Committees' meetings for the financial year is usually given to all the Directors in advance. The Board conducts at least four meetings on a quarterly basis to review the Group's financial results and where necessary, additional board meetings are held to address significant issues or transactions.

Presentations are also made by senior executives on performance of the Group's business and business strategies at the meetings. This allows the Board to have a good understanding of the Group's operations and be actively engaged in robust discussions with the Group's senior executives.

The Company's Constitution (the "Constitution") provides for Directors to conduct meetings by tele-conferencing or by means of similar communication equipment whereby all Directors participating in the meeting are able to hear each other clearly. When a physical meeting is not possible, timely communication with members of the Board can be achieved through electronic means. The Board and Board Committees also approve transactions through circular resolutions, which are circulated to the Board and Board Committees together with all the information relating to the proposed transactions.

The agenda for meetings is prepared in consultation with the Executive Chairman and the Executive Directors and/or the Chairman of the respective Board Committees. The agenda and meeting materials are circulated to the Board and Board Committees in advance of the scheduled meetings.

The Directors will make enquiries on any aspects of the Company's operations or business issues from the Management. The Executive Chairman or Non-Executive Deputy Chairman and CEO or the Company Secretaries will make the necessary arrangements for briefings, informal discussions or explanations, as and when required.

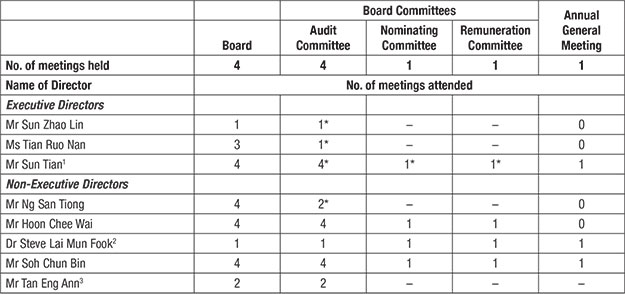

During the financial year, the Board members had met four times. The number of meetings held by the Board and Board Committees and attendance of each board member at the meetings are disclosed in the table reflected below:

* Attendance at meetings on a "By invitation" basis.

1 Mr Sun Tian is the son of Mr Sun Zhao Lin and Ms Tian Ruo Nan, and Alternate Director to Mr Sun Zhao Lin.

2 Dr Steve Lai Mun Fook retired as the Non-Executive and Independent Director on 29 July 2024. Accordingly, he ceased to be the Chairman of NC and a Member of AC and RC.

3 Mr Tan Eng Ann was appointed as the Non-Executive and Independent Director, Chairman of NC and a Member of AC and RC on 7 October 2024.

The Directors were appointed based on their experience, stature, and potential contribution to the proper guidance of the Group and its business. As such, we believe that each individual Director's contributions can be reflected in ways other than the reporting of attendances at board meetings and/or Board Committees meetings.

Despite some of the Directors having multiple board representations, the NC had reviewed the directorship of the Directors and is satisfied that these Directors are able to ensure that sufficient time and attention are given to the affairs of the Company and have adequately carried out their duties as Directors of the Company after taking into consideration the number of listed company board representations and other principal commitments of these Directors.

Currently, the NC and Board do not limit the maximum number of listed board representations which any Director may hold, as long as each of the Board members is able to commit his/her time and attention to the affairs of the Company. The NC and Board believe that each individual Director is best placed to determine and ensure that he/she is able to devote sufficient time and attention to discharge his/her duties and responsibilities as a Director of the Company, having regard to his/her other commitments.

Access to Information

The Directors are provided with board papers and related materials, background or explanatory information in advance of each board meeting to enable them to be properly informed of matters to be discussed and/or approved, as well as ongoing reports relating to operational and financial performance of the Group.

From time to time, the Directors are also informed of any significant developments or events relating to the Group. In addition, the Directors are provided with additional information as needed to make informed decisions to properly discharge their duties and responsibilities. Management ensures that any additional information requested is provided to the Directors in a timely manner.

Independent Access to Management, the Company Secretaries and Other Professional Advisers

Board members have separate and independent access to Management and the Company Secretaries and where required, can obtain additional information to facilitate informed decision-making. Information provided includes background or explanatory materials related to matters to be reviewed and matters under review by the Board, copies of disclosure documents, budgets, forecasts and internal financial statements. Any material variances between the projections and actual results in respect of budgets, is also disclosed and explained.

Minutes of all Board and Board Committee meetings which provide a fair and accurate record of the discussions and key deliberations and decisions taken during the meetings, are circulated and made available to the Board so that Directors are aware of and kept updated as to the proceedings and matters discussed during such meetings.

The Company Secretaries and/or their representatives attend all meetings of the Board and Board Committees and assists in ensuring that relevant procedures are followed and reviewed such that the Board and Board Committees operate effectively. The decision to appoint or remove the Company Secretaries is made by the Board as a whole.

Should Directors, whether as a group or individually, need independent professional advice to enable them to discharge their duties, the Company subject to the approval of the Board, will appoint a professional adviser to render advice at the cost of the Company.

Board Composition and Guidance

Principle 2: The Board has an appropriate level of independence and diversity of thought and background in its composition to enable it to make decisions in the best interests of the company.

The Board comprises seven Directors, three of whom are Non-Executive and Independent Directors, one Non-Executive and Non-Independent Director and three Executive Directors. Majority of the Board is made up of Non-Executive Directors which is in compliance with Provision 2.3 of the Code. Although the Chairman is not independent and the Independent Directors of the Company do not make up a majority of the Board as recommended by Provision 2.2 of the Code, the Board and the NC are satisfied that the Board has substantial independent elements to ensure that objective judgment is exercised on corporate affairs. There is no individual or small group of individuals that dominate the Board's decision-making process. Matters requiring the Board's approval are discussed and deliberated with participation from each member of the Board and all major decisions are made collectively. The NC will continue to review the board composition and size as and when the circumstances arise and make appropriate recommendations to the Board.

As at the date of this report, the composition of the Board is as follows:

| Executive Directors | |

|---|---|

| Mr Sun Zhao Lin | Executive Chairman and Executive Director |

| Ms Tian Ruo Nan | Chief Executive Officer and Executive Director |

| Mr Sun Tian | Executive Director and Group General Manager |

| (Alternate Director to Mr Sun Zhao Lin) | |

| Non-Executive Directors | |

| Mr Ng San Tiong | Deputy Chairman and Non-Executive and Non-Independent Director |

| Mr Hoon Chee Wai | Non-Executive and Lead Independent Director |

| Mr Soh Chun Bin | Non-Executive and Independent Director |

| Mr Tan Eng Ann | Non-Executive and Independent Director |

The profiles of the Directors including their academic and professional qualifications, Board Committees served, directorships or chairmanships for present and past held over the preceding three years in other listed companies and other appointments are set out on Pages 15 to 17 and Page 31 of this Annual Report.

The Board's structure, size and composition are reviewed annually by the NC with a view to determine the impact of its number upon effectiveness. The NC is of the view that the Board is of the appropriate size and with the right mix of skills and diverse expertise and experience given the nature and scope of the Group's operations. The Executive Directors have extensive experience in the crane manufacturing industry while the Non-Executive Directors are well established and competent in their respective professions. No individual or group of individuals dominates the Board's decision-making process. This balance is important in ensuring that the overall direction and strategies proposed by the Management are fully discussed and examined, taking into account the long-term interests of the Company.

Directors' Independence Review

The NC has adopted the criteria on an Independent Director given in the Rule 210(5)(d) of the Listing Manual and Provision 2.1 of the Code. Rule 210(5)(d) of the Listing Manual provides circumstances for which a director will not be independent, including if he is employed or has been employed by the Company or any of its related corporations for the current or any of the past three (3) financial years; if he has an immediate family member who is employed or has been employed by the Company or any of its related corporations in the current or any of the past three (3) financial years, and whose remuneration is or was determined by the RC; and if he has been a director of the Company for an aggregate period of more than nine (9) years (whether before or after listing). Under the Code, a director who is independent in conduct, character and judgement, and has no relationship with the Company, its related corporations, its substantial shareholders or its officers that could interfere, or be reasonably perceived to interfere, with the exercise of the director's independent business judgement in the best interests of the Company, is considered to be independent.

All Directors are required to disclose any relationships or appointment which would impair their independence to the Board in a timely manner. The NC reviews annually the independence of each Director in accordance with the Code's definition of what element constitutes an Independent Director, Practice Guidance to the Code and Rule 210(5)(d) of the Listing Manual. The NC has reviewed the "Confirmation of Independence" forms completed by each Independent Director and is of the view that the three Independent Directors (who represent at least one-third of the Board) are independent, i.e, they have no relationship with the Company, its related companies, its substantial shareholders with shareholdings of 5% or more in the voting shares of the Company, or their officers that could interfere, or be reasonably perceived to interfere, with the exercise of the Director's independent business judgement with a view to the best interests of the Group, and they are able to exercise objective judgement on corporate affairs independently from the Management and the substantial shareholders with shareholdings of 5% or more in the voting shares of the Company.

None of the Non-Executive and Independent Directors and their immediate family member are a substantial shareholder of or partner in or an executive officer of or a Director of, any organisation to which the Company or any of its subsidiaries made, or from which the Company or any of its subsidiaries received, significant payments or materials services aggregated over any financial year in excess of S$50,000 (to an individual) or S$200,000 (to a firm), which may include auditing, banking, consulting and legal services, in the current or immediate past financial year.

The NC has reviewed the independence status of Mr Soh Chun Bin and Mr Tan Eng Ann as the Independent Directors for FY2025, and is satisfied that Mr Soh Chun Bin and Mr Tan Eng Ann are independent in accordance with Provision 2.1 of the Code and Rule 210(5)(d) of the Listing Manual.

Mr Hoon Chee Wai was appointed as a Non-Executive and Independent Director of the Company from 11 February 2009 to 17 August 2012, and has been serving as a Non-Executive and Independent Director again since 2 September 2019. Collectively, he has served the Board for more than nine (9) years. Pursuant to Rule 210(5)(d) of the Listing Manual, Mr Hoon Chee Wai who has served the Board beyond nine (9) years is considered independent until the conclusion of the upcoming annual general meeting ("AGM") of the Company to be held on 28 July 2025.

In view of the requirements that impose hard tenure limit for Independent Directors, Mr Hoon Chee Wai has expressed his intention not to seek for re-election and will be retired as Director upon the conclusion of the forthcoming AGM of the Company. Mr Hoon Cheee Wai will relinquish his position as Non-Executive and Lead Independent Director, Chairman of AC, and a member of NC and RC of the Company. The Board and the NC will endeavour to search for new replacement Independent Director(s) and reconstitute the composition of the Board Committees in due course.

Each NC member has abstained from participating in the discussion and voting on any resolution relating to their independence.

Board Diversity

All Directors have an equal responsibility for the Group's operations, the Independent Directors play an important role in ensuring that the strategies proposed by the Management are constructively challenged and developed by taking into account the long-term interests of the shareholders. The Non-Executive and Independent Directors actively participated during the Board and Board Committees' meetings to discuss matters such as the Group's financial performance, corporate governance initiatives, board processes, succession planning, as well as leadership development and the remuneration of the Executive Directors. Where necessary, the Company would coordinate at least one informal meeting sessions for the Non-Executive and Independent Directors to meet without the presence of the Management and feedback on issues discussed is thereafter provided to the Chairman of the Board.

The Board has adopted a Board Diversity Policy on 3 February 2023 to assist the NC and the Board in identifying prospective candidates for directorship that meet the criteria as determined by the NC and that support the diversity's objectives. The Board Diversity Policy promotes the diversity among the Directors in order to improve performance and to avoid groupthink and foster constructive debate and ensure that composition is optimal to support the Group's needs in the short-term and long-term goals. The diversity includes the appropriate mix of complementary skills, business and industry experience, gender, age, geographic background, length of service and other distinctive qualities of the board members. The Company recognises that an effective Board requires Directors to possess not only integrity, commitment, relevant experiences, qualifications and skills in carrying out their duties effectively but also include right blend of skills, industry knowledge and diverse background towards promoting good corporate governance.

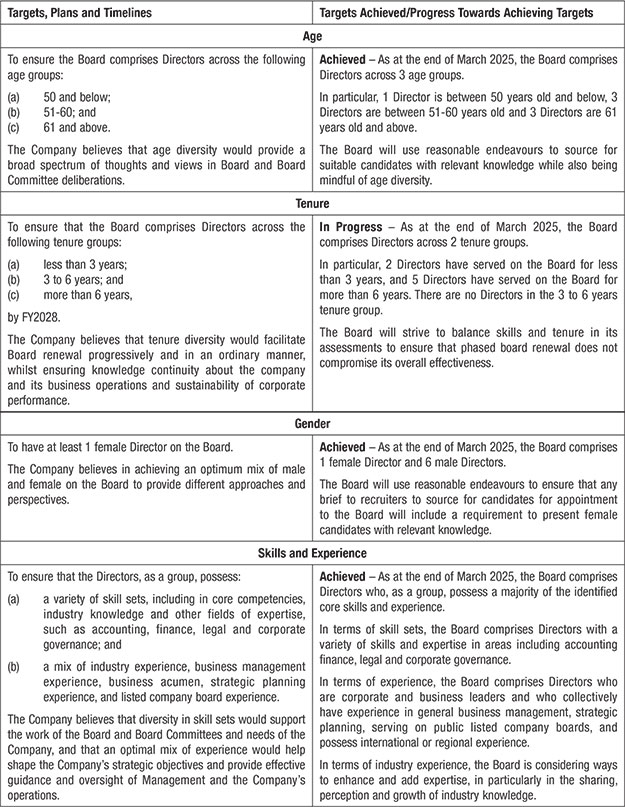

The target, timeline and progress towards achieving the diversity objectives are summarised below:

The targets to ensure the existing skill sets and core competencies of the Board are complementary and enhances the efficacy of the Board and to achieve diversity on the Board are assessed from time to time by the NC, based on the composition of the Board and operations of the Group at the relevant time. In addition, the NC will review the Company's Board Diversity Policy from time to time, as appropriate, and may recommend changes to ensure its continued effectiveness and relevance, and any revisions where necessary will be recommended to the Board for approval.

Chairman and Chief Executive Officer

Principle 3: There is a clear division of responsibilities between the leadership of the Board and Management, and no one individual has unfettered powers of decision-making.

There is a balance of power and authority in the Company, such that no one individual represents a concentration of power. In line with Provision 3.1 of the Code, the roles and responsibilities between the Chairman and the Chief Executive Officer ("CEO") are held by separate individuals to ensure an appropriate distribution of power, increased accountability and greater capacity of the Board for independent decision-making.

Mr Sun Zhao Lin, one of the founders of the Group and the Executive Chairman of the Company, is responsible for the formulation and execution of overall business strategies and policies and future directions, as well as the overall management of the Group. As the Executive Chairman, he is also responsible for representing the Board to shareholders, ensuring that board meetings are held when necessary and board members are provided with adequate and timely information. He approves the board meeting agendas in consultation with the CEO, Chief Financial Officer ("CFO") and Company Secretaries, who act as facilitators at the board meetings, ensures the agenda items are adequately debated at board meetings and maintains regular dialogues with the CEO on operational matters. He also takes a leading role in promoting high standards of corporate governance.

Ms Tian Ruo Nan, spouse of Mr Sun Zhao Lin, is holding the position as CEO of the Company. She is one of the founders of the Group and is responsible for and oversees the day-to-day operations of the Group. As the CEO, she is involved in the day-to-day business of the Group and leads Management in setting strategies, objectives and implementations and is also responsible for the development and financial performance of the Group.

In view that the Chairman and the CEO are immediate family members and part of the Executive Management team, all decisions made by the Board are subject to majority approval of the Board and are reviewed by the relevant Board Committees, whose members comprise of all Non-Executive and Independent Directors. The Board believes that there are adequate safeguards in place to ensure an appropriate balance of power and authority within the spirit of good corporate governance.

Pursuant to Provision 3.3 of the Code, the Board should have a Lead Independent Director to provide leadership in situations where the Chairman is conflicted, and especially when the Chairman is not independent. On 1 October 2023, Mr Hoon Chee Wai has been appointed as the Lead Independent Director of the Company. The Independent Directors, led by Mr Hoon Chee Wai, meet amongst themselves without the presence of the Executive Directors and Non-Independent Directors to discuss matters of significance when required, which are thereon reported to the Chairman of the Board accordingly. Where a situation arises that may involve conflict of interests between the roles of the Chairman and the CEO, it is the Lead Independent Director's responsibility, together with the other Independent Directors to ensure that shareholders' rights are protected. As the Lead Independent Director of the Company, Mr Hoon Chee Wai is the principal liaison on board issues between the Independent Directors and the Chairman of the Board. Mr Hoon Chee Wai also led and coordinated the meetings and activities of the Independent Directors. Mr Hoon Chee Wai is available to shareholders where they have concerns, or when contact through the normal channels to the Chairman, the CEO or the CFO is unsuccessful or inappropriate. Following the retirement of Mr Hoon Chee Wai at the conclusion of the forthcoming AGM, the Board and the NC will diligently seek a suitable candidate to appoint as the new Lead Independent Director in due course.

The Board believes that notwithstanding the close family ties between the Chairman and the CEO with the current composition of the Board, it is able to make objective and prudent judgement on the Group's corporate affairs. The Board is of the view that there are sufficient safeguards and checks to ensure that the process of decision making by the Board is independent and are based on collective decisions without any individual exercising considerable concentration of power or influence.

Board Membership

Principle 4: The Board has a formal and transparent process for the appointment and re-appointment of Directors, taking into account the need for progressive renewal of the Board.

The Board has delegated to the NC the functions of developing and maintaining a transparent and formal process for the appointment and re-appointment of Directors, making recommendations for Directors who are due for retirement by rotation to seek re-election at a general meeting and determining the independence of each Director.

As at the date of this report, the NC comprises of three members, all of whom including the Chairman, are Independent Directors. The Lead Independent Director, Mr Hoon Chee Wai is also a member of the NC:

| Mr Tan Eng Ann | Chairman |

| Mr Hoon Chee Wai | Member |

| Mr Soh Chun Bin | Member |

The NC is established for the purposes of ensuring that there is a formal and transparent process for all board appointments. It has adopted written terms of reference defining its membership, administration and duties.

The NC meets at least once a year and at other times as required. The NC is regulated by its written terms of reference and its key functions include:

- Making recommendations to the Board on the appointment of new Executive and Non-Executive Directors, including making recommendations on the composition of the Board generally and the balance between Executive and Non-Executive Directors appointed to the Board;

- Regularly reviewing the structure, size and composition of the Board having regard to the scope and nature of the operations and the core competencies of the Directors as a group and making recommendations to the Board with regards to any adjustments that are deemed necessary;

- Identifying and nominating candidates for the approval of the Board, determining annually whether or not a Director is independent, filling board vacancies as and when they arise, as well as putting in place plans for succession, in particular for the Chairman, CEO and key management personnel;

- Determining the independence of Directors on an annual basis in accordance with Guideline 2.1 of the Code and Rule 210(5) (d) of the Listing Manual;

- Recommending Directors who are retiring by rotation to be put forward for re-election (including Alternate Director);

- Deciding whether a Director is able to and has been adequately carrying out his/her duties as a Director of the Company, particularly when he/she has multiple board representations;

- Recommending to the Board internal guidelines to address the competing time commitments faced by Directors who serve on multiple boards;

- Assessing the effectiveness of the Board as a whole, its Board Committees and assessing the effective contribution and commitment of each individual Director to the effectiveness of the Board. The results of the performance evaluation will be reviewed by the Chairman and the assessment shall be carried out annually;

- Deciding on how the Board's performance may be evaluated and propose objective performance criteria, subject to the approval of the Board, which allow for comparison with industry peers and which address how the Board has enhanced long-term shareholders' value;

- Reviewing the training and professional development programs for the Directors; and

- Reviewing and approving any new employment of related persons and the proposed terms of their employment.

Process for Re-appointment of Directors

In the deliberations on the re-appointment of existing Directors, the NC takes into consideration the Director's contribution and performance such as his attendance, preparedness, participation and candour.

Regulation 117 of the Constitution requires the number nearest to one-third of the Directors to retire by rotation and subject themselves to re-election by the shareholders at the AGM of the Company. In addition, each Director of the Company shall retire from office once every three years. Directors who retire are eligible to stand for re-election. Regulation 121 of the Constitution provides that additional Directors appointed during the year shall only hold office until the next AGM and shall be eligible for re-election at that AGM. The Board and the NC have developed a process of evaluation of performance of the Board and Board Committees through establishment of quantifiable performance criteria.

In accordance with Regulation 117 of the Company's Constitution, Ms Tian Ruo Nan, Mr Ng San Tiong and Mr Hoon Chee Wai will retire at the forthcoming AGM. Additionally, Mr Tan Eng Ann will retire at the forthcoming AGM pursuant to Regulation 121 of the Company's Constitution.

All retiring Directors have consented to seek re-election as Directors, except for Mr Hoon Chee Wai. The NC is satisfied that all retiring Directors, being eligible, are properly qualified for re-election by virtue of their skills, experience, and their contributions of guidance and time to the Board's deliberations. The NC has recommended the re-election of the retiring Directors who have given their consent. The Board has accepted the NC's recommendation and recommends that shareholders approve the re-election of the retiring Directors. Details of the proposed resolutions are set out in the Notice of AGM in this Annual Report.

Mr Hoon Chee Wai, while eligible for re-election, has expressed his intention not to seek for re-election at the forthcoming AGM and will be retired as Director upon the conclusion of the forthcoming AGM of the Company. Pursuant to Rule 704(8) of the Listing Manual, the Company is in the process of sourcing for suitable candidate and shall endeavour to find the replacement of Mr Hoon Chee Wai and reconstitute the composition of the Board Committees within two months, but in any case not later than three months from his date of cessation. Details of the Directors seeking re-election are found in Table A set out on Pages 47 to 50 of this Annual Report.

Each NC member has abstained from voting on any resolutions and making recommendations and/or participating in any deliberations in respect of matters in which he/she has an interest .

As at the date of this report, the dates of initial appointment and last re-election of each Director are set out below:

The NC decides how the Board's performance is evaluated and proposes objective performance criteria, subject to the approval of the Board, which addresses how the Board has enhanced long-term shareholders' value. The Board also implemented a process to be carried out by the NC to evaluate the effectiveness of the Board as a whole and its Board Committees annually.

The NC has also adopted internal guidelines addressing the commitments that are faced when Directors serve on multiple boards. During the financial year, the NC has reviewed the multiple directorships disclosed by each Director of the Company and their other principal commitments. The NC is satisfied that each Director has allocated sufficient time and attention to the affairs of the Group to adequately discharge their duties as Director of the Company.

Process for Selection and Appointment of New Directors

The Group has in place, policies and procedures for the appointment of new Directors, including the description on the search and nomination procedures. Where a vacancy arises, the NC will consider each candidate based on the selection criteria after consultation with the Board and taking into consideration the qualification, experience, ability to contribute effectively to the Board and to add value to the Group's business, in line with its strategic objectives before recommending the suitable candidate to the Board for approval.

Candidates may be suggested by Directors and Management or sourced from external sources. The NC will interview the candidates and assess them based on objective criteria approved by the Board such as integrity, independent mindedness, possession of the relevant skills required to complement the existing board members, ability to commit the time and effort to carry out his/her responsibilities, good decision making track record, relevant business and management experience and financial literacy. The NC will make a recommendation to the Board on the appointment. The Board appoints the most suitable candidates who must stand for election at the next AGM.

The NC does not have a practice of appointing Alternate Director(s) to Independent Director(s) except for limited periods in exceptional cases such as when a Director has medical emergency. There was no Alternate Director appointed in this financial year except that Mr Sun Tian, the Executive Director and Group General Manager, is the Alternate Director to Mr Sun Zhao Lin, the Executive Chairman and Executive Director.

Succession Planning

Succession planning is an important part of the corporate governance process. The NC seeks to refresh the Board membership progressively and in an orderly manner, to avoid losing institutional memory. Currently, there is an informal succession plan for Management which was put in place by the Chairman. Moving forward and at the relevant time, the NC will look into such plans in close consultation with the Chairman.

Board Performance

Principle 5: The Board undertakes a formal annual assessment of its effectiveness as a whole, and that of each of its board committees and individual Directors.

The NC reviews the criteria for evaluating the Board's performance and recommends to the Board a set of objective performance criteria focusing on enhancing long-term shareholders' value. Based on the recommendations of the NC, the Board has established a formal process for assessment of the effectiveness of the Board as a whole, its Board Committees and individual Directors annually.

The NC undertakes a process to assess the effectiveness of the Board as a whole, its Board Committees and individual Directors for FY2025. The appraisal parameters focus on evaluation of factors such as the size and composition of the Board and its Board Committees, the Board's access to information, Board's processes and accountability, Board's performance in relation to discharging its principal responsibilities, communication with the Management and the standards of conduct of the Directors. The performance measurements ensure that the mix of skills and experience of the Directors continue to meet the needs of the Group.

During the financial year under review, each Director was required to complete the evaluation form and individual Director's assessments adopted by the NC for annual assessment on the overall effectiveness of the Board, its Board Committees and each Director's contributions, and the results have been collated by the Chairman of NC for review or discussion. The results of the individual, Board and Board Committees' assessments are reviewed and discussed by the NC and, any recommendation and suggestion arising from the evaluation exercise are circulated to the Board for consideration on the appropriate measures to be taken.

The NC, in considering the re-nomination of any Director, had considered factors including their performance in the Board as a whole, its Board Committees and individual performance including his/her attendance, preparedness, participation and contribution in the proceedings of the meetings.

The evaluation of Board's performance is conducted annually to identify areas of improvement and as a form of good board management practice. The last Board of Directors' evaluation was conducted on 28 May 2025 and the results have been presented to the NC for discussion. The NC is satisfied that the Board has been effective as a whole and that each Director has contributed to the effective functioning of the Board. In addition, the NC is also satisfied that sufficient time and attention has been given by the Directors to the affairs of the Company, notwithstanding that some of the Directors have multiple board representations.

No external facilitators were used in the assessment of the Board as a whole, its Board Committees and the individual Directors. However, if need arises, the NC has full authority to engage external facilitator to assist the NC to carry out the evaluation process at the Company's expense.

REMUNERATION MATTERS

Procedures for Developing Remuneration Policies

Principle 6: The Board has a formal and transparent procedure for developing policies on Director and executive remuneration, and for fixing the remuneration packages of individual Directors and key management personnel. No Director is involved in deciding his or her own remuneration.

As at the date of this report, the RC comprises of three members, all of whom including the Chairman are Independent Directors:

| Mr Soh Chun Bin | Chairman |

| Mr Hoon Chee Wai | Member |

| Mr Tan Eng Ann | Member |

The RC is established for the purposes of ensuring that there is a formal and transparent procedure for fixing the remuneration packages of individual Director. The overriding principle is that no Director should be involved in deciding his/her own remuneration, except in providing information and documents if specifically requested by the RC to assist in its deliberations.

The RC meets at least once a year and at other times as required. The RC is regulated by its written terms of reference and its key functions include:

- Reviewing and recommending to the Board the remuneration packages and terms of employment of the Executive Directors and senior management or key management personnel;

- Reviewing and recommending to the Board the grant of share options schemes or any long-term incentive schemes which may be set up from time to time;

- Carrying out its duties in the manner that it deemed expedient, subject to any regulations or restrictions that may be imposed upon the RC by the Board from time to time;

- Ensuring that all aspects of remuneration including but not limited to Directors' fees, salaries, allowances, bonuses, options and benefits-in-kind are covered; and

- Reviewing process shall take into consideration the Principles and Provisions of the Code, that the remuneration packages should be comparable within the industry and in comparable companies and shall include a performance-related element coupled with appropriate and meaningful measures of assessing individual Director's and senior management's performance, and that the remuneration packages of employees related to Executive Directors and controlling shareholders of the Group are in line with the Group's staff remuneration guidelines and commensurate with their respective job scopes and levels of responsibility.

The RC has reviewed the framework of remuneration for the Directors and key management personnel, and has determined specific remuneration packages for the Executive Directors, as well as for the key management personnel. The recommendations of the RC are made in consultation with the Non-Executive Directors and submitted for endorsement by the Board.

All aspects of remuneration, including but not limited to Directors' fees, salaries, allowances, bonuses and benefits-in-kind shall be covered by the RC. Each member of the RC shall abstain from voting on any resolutions and making any recommendations and/or participating in any deliberations of the RC in respect of his/her remuneration package.

In structuring and reviewing the remuneration packages, the RC reviews the interests of Directors and key management personnel to align with those of shareholders by linking rewards to corporate and individual performance, as well as roles and responsibilities of each Director and key management personnel. The RC will also review the Group's obligations arising in the event of termination of these service agreements, to ensure that such service agreements contain fair and reasonable termination clauses which are not overly generous. The RC aims to be fair and avoids rewarding poor performance.

The RC is knowledgeable in the field of executive compensation, in considering the remuneration of all Directors, has not sought external professional advice nor appointed independent remuneration consultants.

The Directors' fees to be paid to the Directors are subject to shareholders' approval at the forthcoming AGM for FY2025.

Level and Mix of Remuneration

Principle 7: The level and structure of remuneration of the Board and key management personnel are appropriate and proportionate to the sustained performance and value creation of the company, taking into account the strategic objectives of the company.

The annual reviews of the compensation are carried out by the RC to ensure that the remuneration of the Executive Directors and key management personnel commensurate with their performance and that of the Company, giving due regard to the financial and commercial health and business needs of the Group. The performance of the Executive Directors (together with key management personnel) is reviewed periodically by the RC and the Board.

The Non-Executive Directors receive Directors' fees in accordance with their level of contributions, taking into account the factors such as efforts and time spent, as well as responsibilities and obligations of the Directors. Directors' fees are recommended by the RC and submitted to the Board for endorsement, subject for approval by the shareholders at the AGM of the Company. The Non-Executive Directors should not be over-compensated to the extent that their independence may be compromised and no Director is involved in deciding his/her own remuneration.

The Executive Directors do not receive Directors' fees. The remuneration of the Executive Directors and the key management personnel comprise primarily basic salary component and variable component which is inclusive of bonuses and other benefits. The RC has reviewed and approved the service agreements entered into with the three Executive Directors namely Mr Sun Zhao Lin, Ms Tian Ruo Nan and Mr Sun Tian unless otherwise terminated by either party giving not less than six months' notice in writing for Mr Sun Zhao Lin and Ms Tian Ruo Nan and three months' notice in writing for Mr Sun Tian.

Having reviewed and considered the variable component of the remuneration packages of the Executive Directors and key management personnel, which are moderate, the RC is of the view that the Executive Directors owe a fiduciary duty to the Company. The Company should be able to avail itself to remedies against the Executive Directors in the event of such breach of fiduciary duties. Therefore, there is no necessity for the Company to institute contractual provisions in the service agreements or employment agreements to reclaim incentive components of remuneration paid in prior years from the Executive Directors and key management personnel in exceptional circumstances of misstatement of financial statements, or of misconduct resulting in financial loss to the Company.

The Company currently has no employee share option scheme or other long-term incentive scheme in place. The RC will explore a suitable incentive plan/scheme as and when it deems necessary.

Disclosure on Remuneration

Principle 8: The company is transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration, and the relationships between remuneration, performance and value creation.

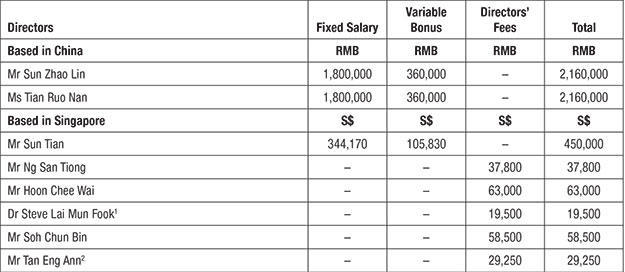

Directors' Remuneration

The breakdown of the remuneration of the Directors and CEO for FY2025 is set out below:

Notes:

1 Dr Steve Lai Mun Fook retired as the Non-Executive and Independent Director on 29 July 2024. Accordingly, he ceased to be the Chairman of NC and a Member of AC and RC.

2 Mr Tan Eng Ann was appointed as the Non-Executive and Independent Director, Chairman of Nominating Committee and a Member of AC and RC on 7 October 2024.

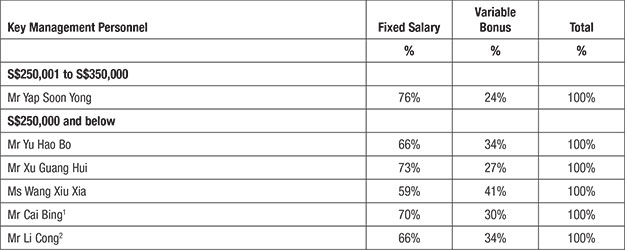

Key Management Personnel Remuneration

The breakdown of the total remuneration of the key management personnel (who are not Directors or the CEO), in percentage terms showing the level and mix, for FY2025 falling within the bands of S$250,000 is set out below:

Notes:

1 Mr Cai Bing was appointed as the Head of Department, Research & Development on 1 July 2024.

2 Mr Li Cong was appointed as the Head of Production Department on 1 July 2024.

The aggregate total remuneration paid/accrued to the key management personnel (who are not Directors or the CEO) for FY2025 is approximately S$767,000.

The Company is transparent on its remuneration policies, which has been disclosed not only as part of compliance with Principle 8 but also in respect of Principle 7 of the Code. In particular, the Company has elaborated on the remuneration policy governing the remuneration of the Executive Directors and the factors taken into account for the remuneration of the Non-Executive and Independent Directors. The Company has also disclosed the remuneration paid by the Company and its subsidiaries to each Director and the CEO, as well as the breakdown of the components of their remuneration, for transparency, in accordance with the Rule 1207(10D) of the Listing Manual.

In considering the disclosure of remuneration of the key management personnel of the Group, the Board is of the opinion that given the confidential nature of and commercial sensitivities associated with remuneration matters and the highly competitive talent resource environment in which the Group operates where our key management personnel are required to have in-depth knowledge of our business and proprietary assets, it is not in the best interest of the Group to disclose the exact details of the remuneration of each key management personnel, so as to prevent poaching of key management personnel. The Company has disclosed the remuneration paid to each key management personnel using percentage terms and remuneration bands, as well as the breakdown components of their remuneration, for transparency. Accordingly, the Board is of the view that the non-disclosure of the exact quantum of the remuneration of each key management personnel will not be prejudicial to the interest of shareholders and complies with the intent of Provision 8.1 of the Code.

The RC has reviewed and approved the remuneration packages of the Executive Directors and key management personnel, having regard to their contributions as well as the financial performance and commercial needs of the Group and has ensured that the Executive Directors and key management personnel are adequately but not excessively remunerated. The RC will consider and deliberate on the performance conditions to which Executive Directors' and key management personnel's entitlement to short-term and long-term incentive schemes and will make the necessary disclosures as and when it deems necessary.

Shareholders' approval will be sought at the forthcoming AGM of the Company on 28 July 2025 for the payment of Directors' fees proposed for FY2025 and the financial year ending 2026, amounting to an aggregate of S$208,050 and S$202,050 respectively.

There were no termination, retirement and post-employment or other long-term incentive granted to the Directors or key management personnel.

Employees who are Substantial Shareholders, or Related to a Director, the CEO or a Substantial Shareholder

There is no employee of the Group who is a substantial shareholder of the Company, or an immediate family member of Directors, the CEO or a substantial shareholder of the Company and whose remuneration has exceeded S$100,000 during FY2025.

ACCOUNTABILITY AND AUDIT

Risk Management and Internal Controls

Principle 9: The Board is responsible for the governance of risk and ensures that Management maintains a sound system of risk management and internal controls, to safeguard the interests of the company and its shareholders.

The Board recognises the importance of sound internal controls and risk management practices to good corporate governance. The Board affirms its overall responsibility for the Group's systems of internal controls and risk management, and for reviewing the adequacy and effectiveness of those systems on an annual basis. The internal control and risk management functions are performed by the Group's key management personnel and reported to the AC for review.

It should be noted, in the opinion of the Board, that such system is designed to manage rather than to eliminate the risk of failure to achieve business objectives, and that it can provide only reasonable, and not absolute, assurance against material misstatement of loss, and include the safeguarding of assets, the maintenance of proper accounting records, the reliability of financial information, compliance with appropriate legislation, regulation and best practice, and the identification and containment of business risk.

The Board understands its accountability to shareholders on the Group's position, performance and progress. The Board will update shareholders on the operations and financial position of the Company through half year and full year financial results announcements, as well as timely announcements of other matters as prescribed by the relevant rules and regulations to provide the shareholders with a balanced and understandable analysis and explanation of the Group's financial performance, position and prospects. The Management provides the Board on a quarterly basis, financial reports and other information on the Group's performance, financial position and prospects for their effective monitoring and decision-making.

The Board has also taken steps to ensure compliance with legislative and regulatory requirements. In line with the Listing Manual, the Board provides a negative assurance statement to the shareholders in respect of the interim financial statements. For the financial year review, the CEO and CFO have provided assurance to the Board on the integrity of the Group's financial statements.

The Directors and executive officers of the Company have provided undertakings of compliance with the requirements of the SGX in accordance with Rule 720(1) of the Listing Manual.

It is the Board's policy to provide the shareholders with all important and price sensitive information on a timely basis, through SGXNet in the form of half-yearly announcements, or as and when necessary in order to discharge their duties effectively.

The Board with assistance from the Enterprise Risk Management Committee ("ERMC") and the AC, is responsible for the governance of risk by ensuring that Management maintains a sound system of risk management and internal controls to safeguard shareholders' interests and the Group's assets, and determines the nature and extent of the significant risks which the Board is willing to take in achieving strategic objectives.

The ERMC, which comprises of key management of the Group, was formed in year 2012 to assist Management in its role of managing risks, as part of the Group's efforts to strengthen its risk management processes and enable accountability for its adequacy and effectiveness. The ERMC reports to the AC which, in turn, reports to the Board.

An Enterprise Risk Management ("ERM") programme has been implemented to identify, prioritise, assess, manage and monitor key risks. The risk management process in place covers, inter alia, financial, operational (including information technology) and compliance risks faced by the Group. From year 2012 to year 2015, the Management with the assistance of the Internal Auditors has enhancing the ERM programme over the identification, prioritisation, assessment, management and monitoring of key risks. The Management continued to adopt the risk management framework established. Key risks identified are deliberated by key management, and reported to the AC on a regular basis. The AC reviews the adequacy and effectiveness of the ERM programme against identified significant risks vis-à-vis changes in the Group's operating environment.

Relying on the reports from the Internal Auditors and External Auditors, the AC carried out assessment of the effectiveness of key internal controls during the financial year. Any material non-compliance or weaknesses in internal controls or recommendations from the Internal Auditors and External Auditors to further improve the internal controls were reported to the AC. The AC will also follow up on the actions taken by the Management on the recommendations made by the Internal Auditors and External Auditors.

For FY2025, the Board has received assurance from:

- the CEO and CFO of the Company that the financial records have been properly maintained and the financial statements give a true and fair view of the Company's operations and finances; and

- the CEO and other key management personnel who are responsible, regarding the adequacy and effectiveness of the Group's risk management systems and internal control systems in addressing financial, operational, compliance and information technology risks are operating effectively.

Based on the internal controls in place, the reports from the Internal Auditors and External Auditors, as well as reviews conducted by the Management, the Board with the concurrence of the AC, is of the opinion that the Group's system of internal controls and risk management procedures in addressing the financial, operational, compliance and information technology controls, and risk management systems maintained by the Group during the FY2025 are adequate and effective.

The Board recognises that the risk management and internal control systems established by the Group provides reasonable, but not absolute, assurance that the Group will not be adversely affected by any event that can be reasonably foreseen as it strives to achieve its business objectives. The Board also noted that all internal control systems contain inherent limitations and no system of risk management and internal controls can provide absolute assurance against the occurrence of material errors, poor judgement in decision-making, human error, losses, fraud or other irregularities.

Audit Committee

Principle 10: The Board has an Audit Committee which discharges its duties objectively.

As at the date of this report, the AC comprises of three members, all of whom are Independent Directors:

| Mr Hoon Chee Wai | Chairman |

| Mr Soh Chun Bin | Member |

| Mr Tan Eng Ann | Member |

The AC is established to assist the Board with discharging its responsibility to safeguard the Company's assets, maintain adequate accounting records and develop and maintain effective systems of internal control. The Board is of the view that the members of the AC are appropriately qualified in that they have sufficient accounting or related financial management expertise and experience to discharge its responsibilities properly.

The AC is governed by its terms of reference, which was reviewed and amended, where appropriate, to adopt relevant best practices set out in the Guidebook and the Code. The terms of reference is used as a reference to assist the AC in discharging its responsibilities and duties, which include:

- Reviewing the audit plans of the Company's External Auditors, including the results of the Auditors' review and audit report, the management letter and the Management's response and evaluation of the Company's system of internal controls;

- Ensuring coordination where more than one audit firm is involved;

- Reviewing the semi-annual and annual financial statements of the Group focusing in particular, on significant financial reporting issues and judgements, any significant adjustments, changes in accounting policies and practices, major risk areas, significant adjustments resulting from the audit, the going concern statement, compliance with accounting standards, stock exchange and statutory/regulatory requirements before submission to the Board for approval;

- Reviewing announcements relating to the Company's financial performance;

- Discussing problems and concerns arising from the audits, in consultation with the External Auditors and Internal Auditors where necessary and to meet the External Auditors and Internal Auditors without the presence of the Management, at least once annually;

- Reviewing the assistance and cooperation given by the Management to the External Auditors;

- Reviewing annually the scope and results of the audit and its cost effectiveness as well as the independence and objectivity of the External Auditors;

- Reviewing the internal audit programme and ensure coordination between External Auditors and Internal Auditors and the Management;

- Reviewing the adequacy of the Company's internal controls;

- Reviewing the scope and results of the internal audit procedures including the effectiveness of the internal audit functions and ensure that the audit functions are adequately resourced;

- Reviewing with the External Auditors, any suspected fraud or irregularity, or suspected infringement of any relevant laws, rules or regulations, which has or is likely to have a material impact on the Company's operating results or financial position and the Management's response;

- Reviewing arrangements by which staff of the Company may, in confidence, raise concerns about possible improprieties in matters of financial reporting or other matters and ensure that arrangements are in place for the independent investigations of such matters and for appropriate follow up actions;

- Reviewing any potential conflict of interest and to set out a framework to resolve or mitigate any potential conflict of interest;

- Reporting to the Board its findings from time to time on matters arising and requiring the attention of the committee;

- Reviewing Interested Person Transactions, falling within the scope of Chapter 9 of the Listing Manual;

- Recommending to the Board the appointment, re-appointment and removal of the External Auditors and approve the remuneration and terms of engagement of the External Auditors;

- Determining the Company's level of risk tolerance and risk policies, and oversee Management in the design, implementation and monitoring of the risk management and internal control systems;

- Undertaking such other reviews and projects as may be requested by the Board and report to the Board its findings from time to time on matters arising and requiring the attention of the AC; and

- Undertaking generally such other functions and duties as may be required by statute or the Listing Manual of the SGX-ST, and by such amendments made thereto from time to time.

Apart from the above functions, the AC shall commission and review the findings of internal investigations into matters where there is any suspected fraud or irregularity, or failure of internal controls or infringement of any Singapore laws, rules or regulations which has or is likely to have a material impact on the Group's operating results and/or financial position. Each member of the AC shall abstain from voting on any resolutions and/or participating in any deliberations of the AC in respect of matters in which he is interested.

The AC has full access to and cooperation of the Management, External Auditors and Internal Auditors. It also has the discretion to invite any Director and/or key management personnel to attend its meetings. The AC has adequate resources to enable it to discharge its responsibilities properly.

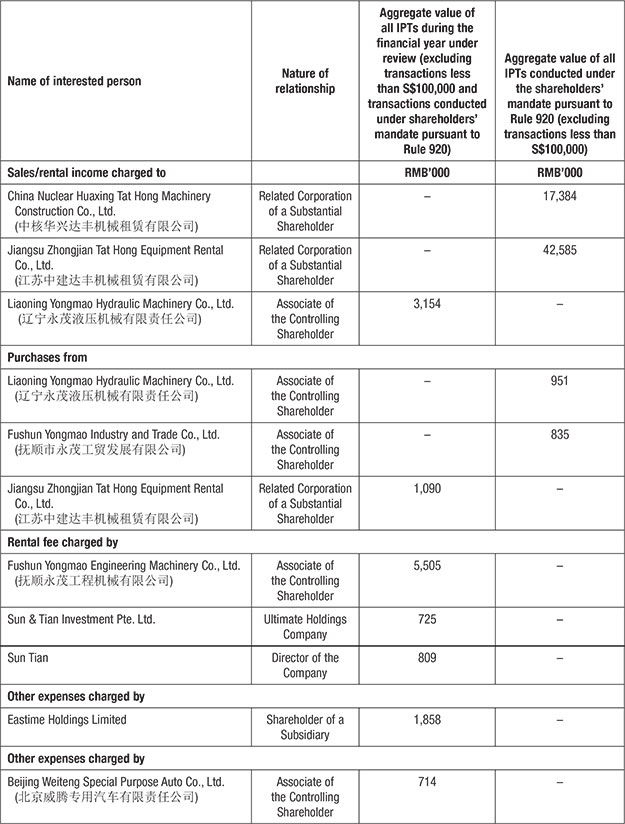

The AC has reviewed all Interested Person Transactions for FY2025 and is of the opinion that Chapter 9 of the Listing Manual has been complied.

For FY2025, the AC met once with the External Auditors without the presence of the Management. The AC also reviewed the independence and objectivity of the External Auditors through discussions with the External Auditors and reviewed the non-audit fees, if any, awarded to them. There were no non-audit services provided by the External Auditors for FY2025. After reviewing the services provided during the financial year, the AC is satisfied that the independence and objectivity of the External Auditors are not in any way impaired.

The Company has complied with Rule 715 of the Listing Manual of the SGX-ST as all principal subsidiaries of the Company are audited by Messrs PKF-CAP LLP. All other foreign-incorporated subsidiaries are audited by suitable auditing firms for the purposes of the consolidated financial statements of the Group and audited by Messrs PKF-CAP LLP for consolidation purposes.

The AC undertakes a review of the scope of services provided by the External Auditors, the independence and the objectivity of the External Auditors on an annual basis. Messrs PKF-CAP LLP, the External Auditors of the Company, has confirmed that they are a Public Accounting Firm registered with ACRA and provided a confirmation of their independence to the AC. The AC had assessed the External Auditors based on factors such as performance, adequacy of resources and experience of their audit engagement partner and auditing team assigned to the Group's audit, the size and complexity of the Group. Accordingly, the AC is satisfied that Rule 712 of the Listing Manual is complied, and has recommended to the Board that Messrs PKF-CAP LLP be nominated for re-appointment as External Auditors at the forthcoming AGM of the Company.

The AC had reviewed and evaluated the performance of the External Auditors based on the key indicators of audit quality and guidance, where relevant, as set out in the Guidance to Audit Committee on Evaluation of Quality of Work performed by the External Auditors and Audit Quality Indicators Disclosure Framework published by ACRA such as performance, adequacy of resources and experience of their audit engagement partner and auditing team assigned to the Group's audit, taking into account the size and complexity of the Group.

Changes to accounting standards and accounting issues which have significant impact on the financial statements were reported to the AC, and highlighted by the External Auditors in their meetings with the AC. In line with Provision 10.3 of the Code, the AC does not comprise of former partners or directors of the Company's existing auditing firm or auditing corporation: (a) within a period of 2 years commencing on the date of their ceasing to be a partner of the auditing firm or director of the auditing corporation; and in any case, (b) for as long as they have any financial interest in the auditing firm or auditing corporation.

In the review of the financial statements, the AC has discussed with Management and the External Auditors the accounting principles that were applied and their judgment of items that might affect the true and fair view of the financial statements. In particular, the following key audit matters impacting the financial statements were discussed with Management and the External Auditors and were reviewed by the AC.

| Key audit matters | How the AC reviewed these matters and what decisions were made |

|---|---|

| Impairment of trade receivables | The collectability of long outstanding debts and the reasonableness of Management's expected credit losses ("ECL") assessment were reviewed by the AC. The AC concurred with Management's assessment regarding the basis on which the ECL has been applied to determine the adequacy of the allowance for impairment losses made in its financial statements. |

| Revenue recognition on sale of manufactured tower cranes | The AC reviewed Management's approach and assessment of the internal controls over the recognition of revenue. The AC was satisfied that Management's approach and assessment of internal controls over revenue recognition were appropriate. |

Whistle-Blowing Policy

The AC had reviewed, approved and implemented an independent whistle-blowing framework which provides well-defined and accessible channels in the Group through which employees of the Group may, in confidence, raise concerns about possible improprieties in matters of financial reporting or other matters within the Group. The framework includes arrangements for independent investigations and appropriate follow-up of such matters. Details of the whistle-blowing policies and arrangements have been made available to the employees. The whistle-blowing policies are designated to investigate whistleblowing reports made in good faith and ensures that the identity of the whistle-blower is kept confidential and the Group is committed to ensure protection of the whistle-blower against detrimental or unfair treatment. The AC is responsible for oversight and monitoring of whistle-blowing. As at the date of this report, there was no report received through the whistle-blowing mechanism.

The AC had reviewed the Company's key financial risk areas and noted that apart from the foreign exchange rate differences which arise when transactions are denominated in foreign currencies, the Group has not entered into any financial derivatives contracts which will give rise to financial risks.

The AC has explicit authority to investigate any matter within its terms of reference. The AC has, within its terms of reference, the authority to obtain independent professional advice at the Company's expenses as and when the need arises.

Internal Audit

The Board recognises the importance of maintaining a system of internal controls in order to safeguard the shareholders' investments and the Company's assets. The Company has outsourced its internal audit functions of the Group to Yang Lee & Associates, a professional firm to perform the review and test of controls of its processes. As recommended by the AC, the Board approved the appointment of Yang Lee & Associates as Internal Auditors of the Group. The internal audit function is expected to meet the standard set by internationally recognised professional bodies including the International Standards for the Professional Practice of Internal Auditing set by The Institute of Internal Auditors. The Internal Auditors has unfettered access to all the Company's documents, records, properties and personnel, including access to the Board, the AC and Management, where necessary, and has the right to seek information and explanation.

The appointed Internal Auditors reports directly to the AC and is responsible for assessing the reliability, adequacy and effectiveness of the system of internal controls to protect the fund and assets of the Group. The Internal Auditors also ensure that control procedures are complied, by assessing that the operations of the business processes under review are conducted efficiently and effectively and identifying and recommending improvement to internal control procedures, where required.

The Internal Auditors plans its internal audit schedules in consultation with, but independent of, the Management. The internal audit plan is submitted to the AC for approval prior to the commencement of the internal audit. The AC will review the activities of the Internal Auditors, including overseeing and monitoring the implementation of improvements on identified internal control weaknesses.

For FY2025, the AC met once with the Internal Auditors without the presence of the Management. The AC is of the opinion that Yang Lee & Associates is adequately resourced with qualified personnel to discharge its responsibilities. The AC has reviewed the internal audit reports based on the controls in place and is satisfied that the internal audit functions has been (i) adequately resourced, (ii) staffed by suitably qualified and experienced professionals with the relevant experience and has the appropriate standing within the Group, and (iii) in accordance with the standards set by professional bodies. Yang Lee & Associates has provided a confirmation on their independence to the AC.

Based on the scope of work performed by the Internal Auditors for FY2025, there were no material weaknesses identified.

SHAREHOLDER RIGHTS AND ENGAGEMENT

Shareholder Rights and Conduct of General Meetings

Principle 11: The company treats all shareholders fairly and equitably in order to enable them to exercise shareholders' rights, and have the opportunity to communicate their views on matters affecting the company. The company gives shareholders a balanced and understandable assessment of its performance, position and prospects.

All shareholders are treated fairly and equitably to facilitate their ownership rights to participate effectively in and vote at general meetings. Shareholders are also informed on the procedures for the poll voting at the general meetings. The Constitution allows a member of the Company, who is unable to attend the general meeting in person, to appoint up to two proxies to attend and vote at the meeting in place of the member.

The Company believes in high standards of transparent corporate disclosure, in line with the continuous obligations of the Company under the Listing Manual of the SGX-ST and the Companies Act 1967. The Board's policy is that all shareholders should equally and on a timely basis be informed of all major developments that impact the Group. Half yearly financial results and news releases (if any) will be published through the SGXNet. Where there is inadvertent disclosure made to a selected group, the Company will make the same disclosure publicly to all others as soon as practicable.

The forthcoming AGM in respect of FY2025 will be held in a wholly physical format. The arrangements relating to attendance and voting at the AGM, appointment of proxies, submission of questions in advance of the AGM, addressing of substantial and relevant questions at the AGM and access to documents, will be set out in the Notice of AGM. The Notice of AGM, the Proxy Form and the Request Form will be sent to shareholders by mail prior to the AGM within the prescribed statutory period. As part of the Group's commitment to conserve the environment, the Company will provide the shareholders printed copies of the Annual Report and appendix (if any) via post upon specific request by them for it. All these documents will also be made available to shareholders electronically at the Company's website at http://www.yongmaoholdings.com/.

The Board noted that there should be separate resolutions on each substantially separate issue that may be tabled at the general meeting. Notices of general meetings are announced via SGXNet within the mandatory period prior to the meetings (or as otherwise disseminated in accordance with such laws and regulations as may be applicable), together with explanatory notes or a circular on items of special business (if necessary), at least 14 clear calendar days before the meeting for ordinary resolutions and/or at least 21 clear calendar days before the meeting for special resolutions, so as to enable shareholders to exercise their voting rights on an informed basis.